Value Investing 2.0

Invest like Buffett? Valueinvesting2.com’s value investing app combines Wall Street’s top ratings with the best wealth management research to create the world’s only stock, ETF, and mutual fund ratings / research. 2M+ love our website; now were mobile. Buy low, sell high, sleep well... download now.

What’s Value investing: When you shop for a new TV, do you cheer when the price goes up? No! We want prices to fall. Value Investing 2.0 calculates an investment’s true (intrinsic) price. If the stock falls way below that price, it’s a buy; above, and its a sell. Research shows that stock prices go back to their intrinsic value. Now you can profit from that knowledge from hot stock picks to penny stocks.

How should you use Value Investing 2.0’s App? As the perfect wealth management / financial advisor companion. Use Betterment, Wealthfront, SigFig, or Acorn? Value Investing 2.0’s investing research and ratings help investors make better wealth building choices. Trade through Etrade, Scottrade, or Wells Fargo? Before you click that stock purchase, look up your investment in the Value Investing 2.0’s app. Jim Cramer talking about ETFs? Value Investing 2.0 invented the first understandable ETF ratings & research. Mutual funds? Ratings for those too!

Upgraded Features

•Wealth Management: Which is a better investment,… an ETF, mutual fund, or a stock? Stop guessing. Value Investing 2.0’s wealth-odometer simplifies investing decisions. Value Investing 2.0’s value investing ratings are easy to compare across investments. If you can drive, you can buy the best investments in the world.

•Watch List: Check our ratings, add them to your watch list, and see how well our algorithm works. This is a pure show of confidence but hey, we believe in our ratings!

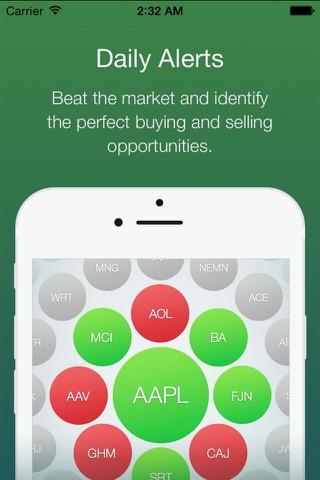

•Stock Alerts: Its easy to get a list of hot stocks or trending stocks that are making big gains or losses on any particular day, but what do you do with that information? When a hot stock goes up, is it still a buy or is it a sell? With Value Investing 2.0s stock alerts, you see on a daily basis, which stocks should be in your stock portfolio and which could be victims of the next bear market.

•Buy/Sell/Hold ratings: What are the best stocks to own? On Wall Street a “hold” actually means a sell. At Value Investing 2.0 a Buy rating means it’s undervalued, a hold rating means hold on to it (duh!), and a sell rating means get out quickly. Makes senses?

•Potential: Value Investing 2.0 measures investment potential based on a stock’s intrinsic value. If a stocks price has the potential to increase by 50%, then it gets a buy. If the stock is overvalued, then it gets a sell rating. Anything in between gets a hold rating. Hot stocks, penny stocks, short stocks are easy to spot.

•Discounted “Cash Flow” DCF Model: This approach computes an investing value by counting the cash a business will make over its lifetime.

•Market “Comparative” Model: This approach looks at how the valuation of a single stock compares to its closest competitors.

•Buffett Secret Formula: Value Investing 2.0’s analysts invented this amazing wealth building tool by mimicking the way Warren Buffett assesses stocks. If anyone knows the best stocks to own, its Warren Buffett.

WikiPremium Subscription Service for ETF and mutual fund data access

Monthly/Yearly Subscription

• $4.99 per Month or $49.99 per Year

• Payment will be charged to iTunes Account at confirmation of purchase

• Subscription automatically renews unless auto-renew is turned off at least 24-hours before the end of the current period

• Account will be charged for renewal within 24-hours prior to the end of the current period, and identify the cost of the renewal

• Subscriptions may be managed by the user and auto-renewal may be turned off by going to the users Account Settings after purchase

• No cancellation of the current subscription is allowed during active subscription period

• Privacy Policy: http://www.valueinvesting2.com/disclaimer/